Parsippany, N.J., July 30, 2021 – AdvanSix (NYSE: ASIX) today announced its financial results for the second quarter ending June 30, 2021. Overall, the Company generated record sales, earnings and margin in the quarter reflecting strong execution amid improving end market demand and tight industry supply conditions.

Second Quarter 2021 Results

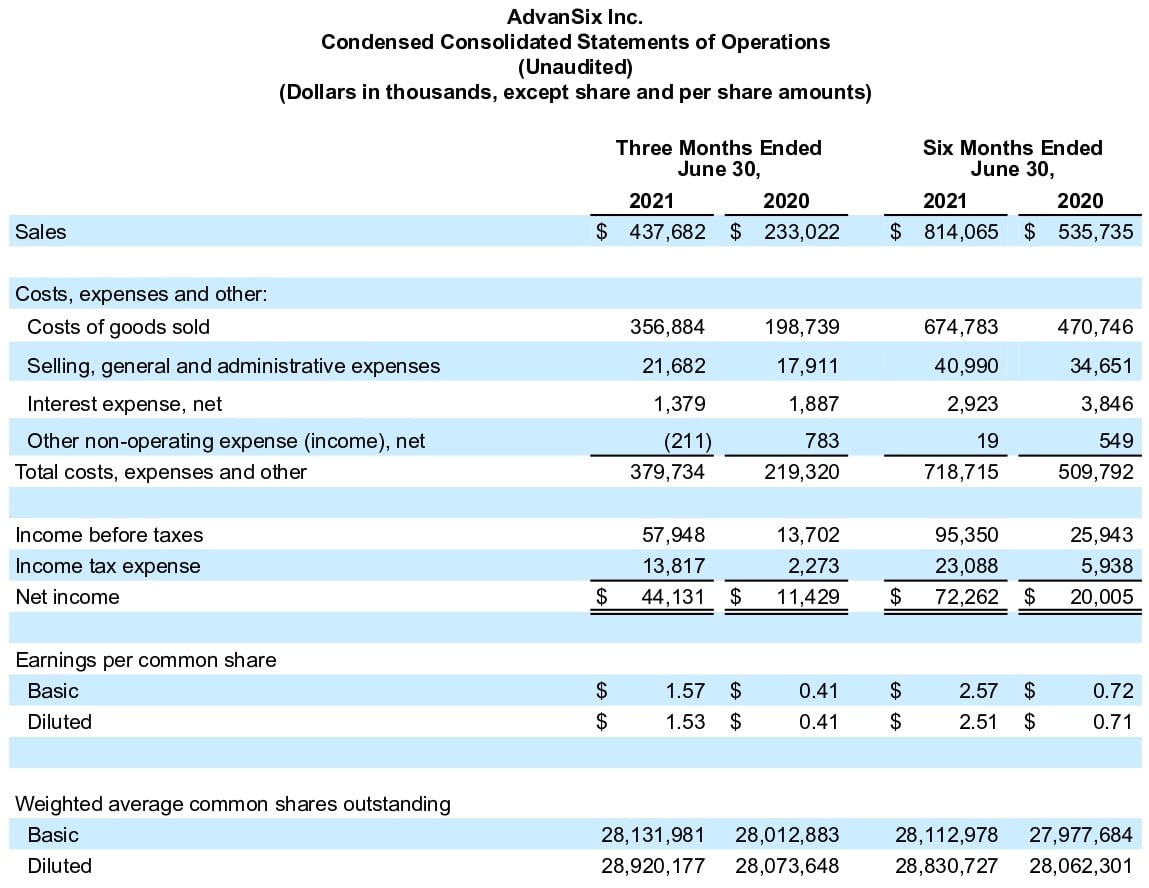

- Sales up approximately 88% versus prior year driven by 32% higher volume, 31% higher raw material pass-through pricing and 25% favorable impact of market-based pricing

- Net Income of $44.1 million, an increase of $32.7 million versus the prior year

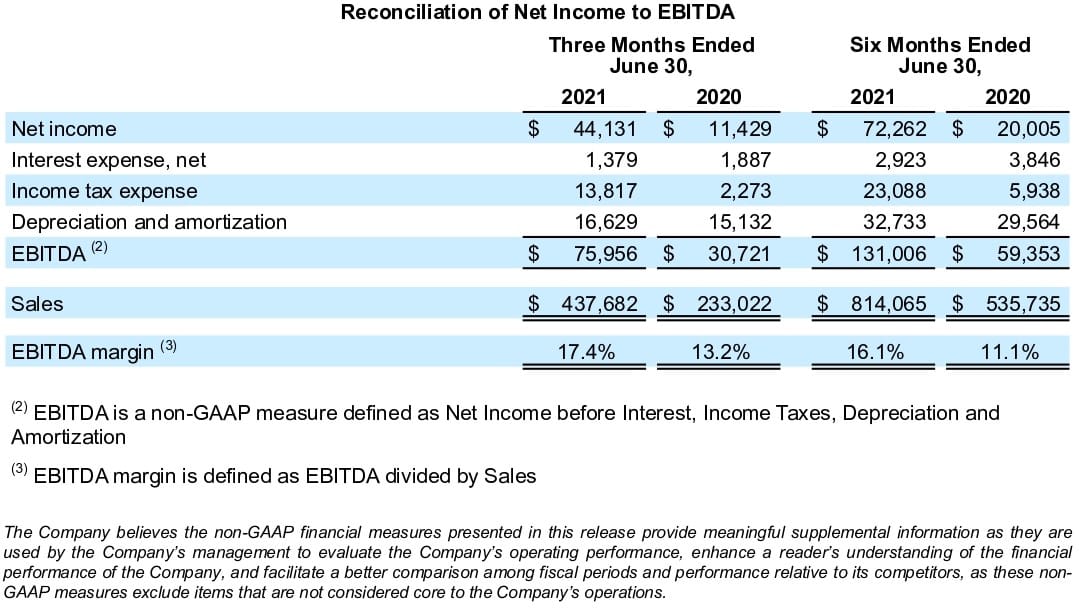

- EBITDA of $76.0 million, an increase of $45.2 million versus the prior year

- EBITDA Margin of 17.4%, an increase of 420 bps versus the prior year

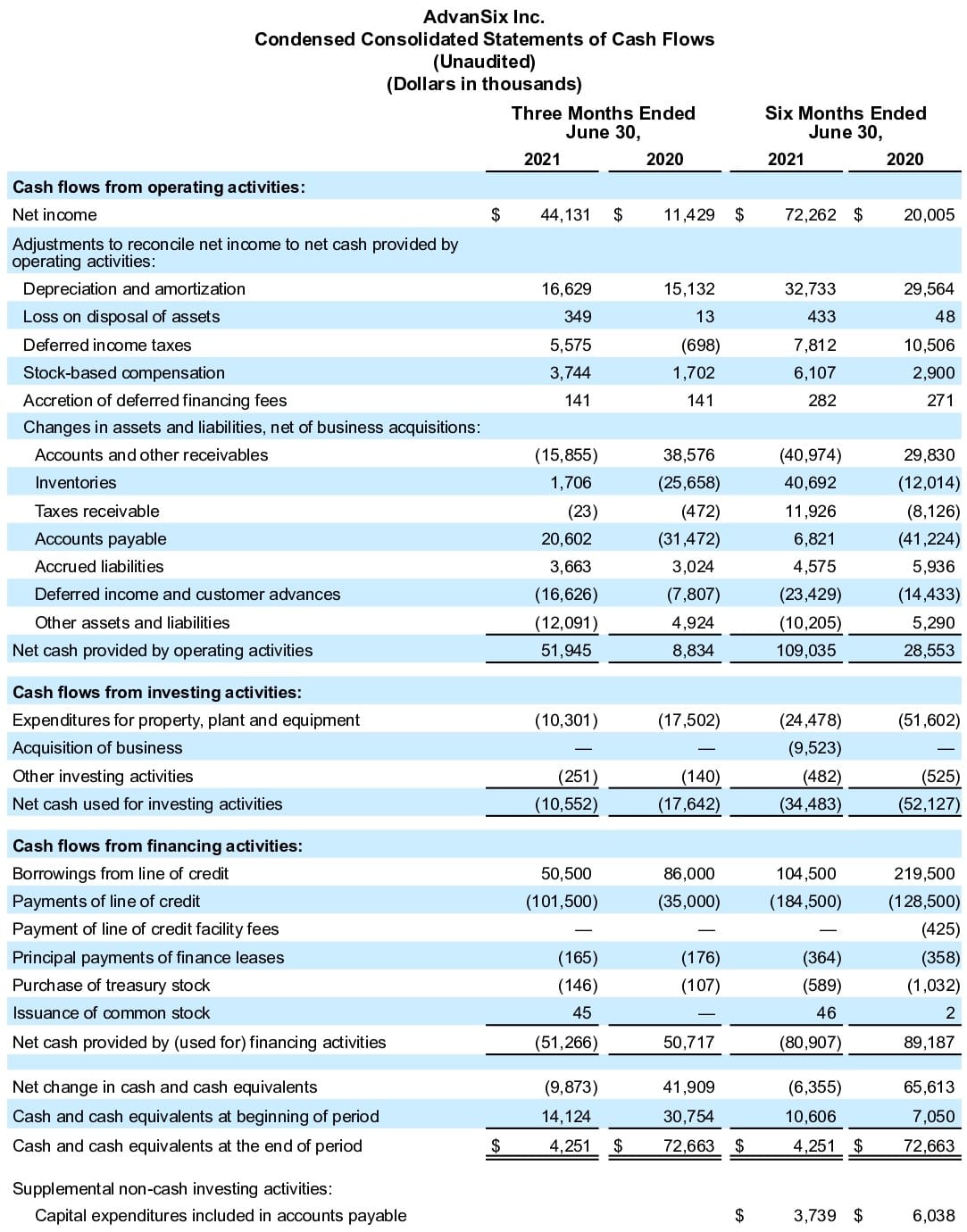

- Cash Flow from Operations of $51.9 million, an increase of $43.1 million versus the prior year

- Capital Expenditures of $10.3 million, a decrease of $7.2 million versus the prior year

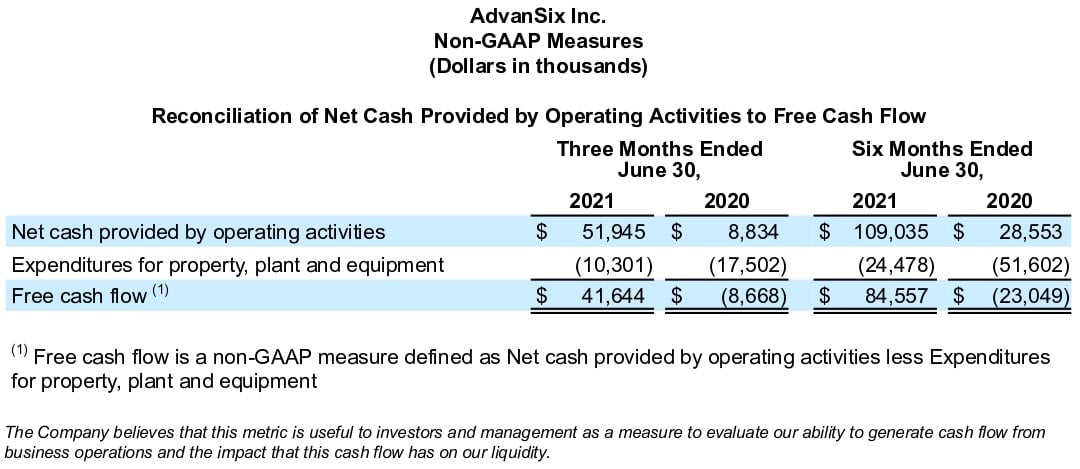

- Free Cash Flow of $41.6 million, an increase of $50.3 million versus the prior year

“Our entire organization performed exceptionally well in the current set of industry conditions to support our customers throughout the quarter while delivering record sales, earnings and margin performance,” said Erin Kane, president and CEO of AdvanSix. “Our record performance is attributable to strong volume and pricing improvement including continued growth in differentiated products amid favorable end market conditions and tight industry supply. Demand has improved across a number of the diverse end markets we serve including building and construction, auto, electronics, packaging, paints and coatings, and solvents as well as the strongest set of agricultural industry fundamentals seen in the last decade. Across the board, it has been a terrific first half of 2021 with robust earnings and cash flow performance reflecting strong execution and the strength of our business model and portfolio.”

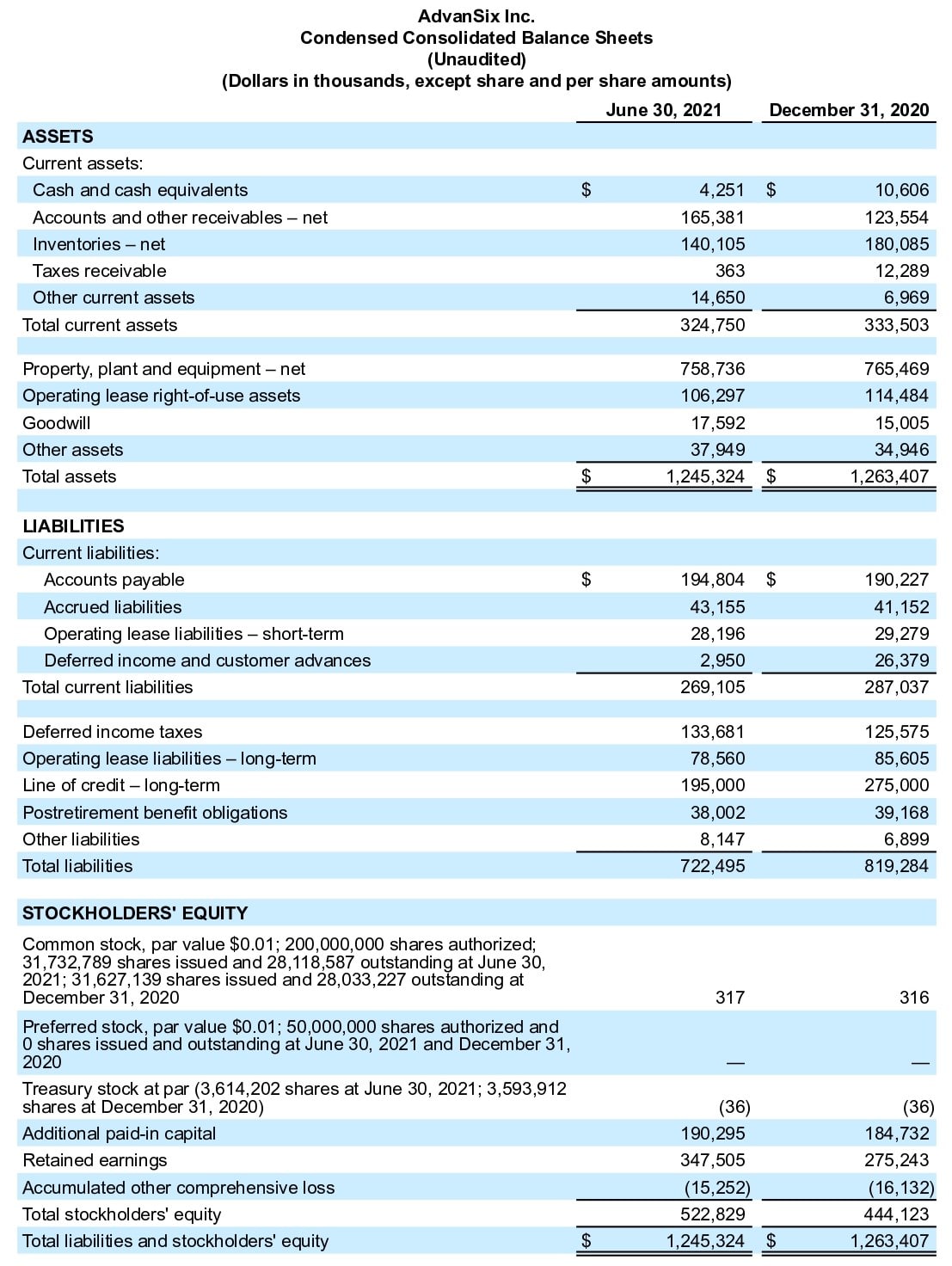

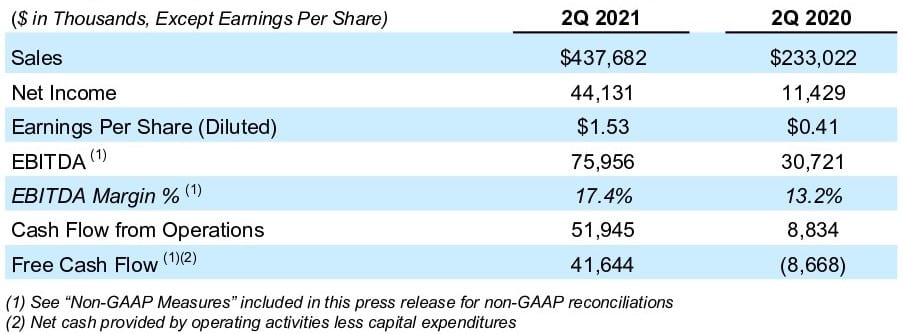

Summary second quarter 2021 financial results for the Company are included below:

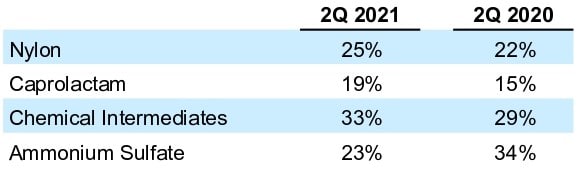

Sales of $437.7 million increased approximately 88% versus the prior year. Sales volume in the quarter increased 32% driven by improved end market demand across our product lines. Raw material pass- through pricing was favorable by 31% following a net cost increase in benzene and propylene (inputs to cumene which is a key feedstock to our products). Market-based pricing was favorable by 25% compared to the prior year driven by higher pricing across each of our product lines.

Sales by product line represented the following approximate percentage of our total sales:

EBITDA of $76.0 million in the quarter increased $45.2 million versus the prior year primarily due to higher volume and market-based pricing, partially offset by the unfavorable impact of higher raw material costs including natural gas and sulfur. 2Q 2021 EBITDA included approximately $2 million favorable impact of initial insurance proceeds related to the 2019 shutdown of cumene supplier Philadelphia Energy Solutions (PES).

Earnings per share of $1.53 increased $1.12 versus the prior year driven by the factors discussed above, partially offset by a higher effective tax rate in the quarter. The effective tax rate in the quarter was 23.8% compared to 16.6% in the prior year period primarily driven by state taxes and research tax credits in the prior year period, which had a larger impact on reducing the tax rate in that period due to lower income.

Cash flow from operations of $51.9 million in the quarter increased $43.1 million versus the prior year primarily due to higher net income, partially offset by the unfavorable impact of changes in working capital. Capital expenditures of $10.3 million in the quarter decreased $7.2 million versus the prior year reflecting capital process efficiencies and timing of project execution.

Outlook

- Expect steady North America nylon demand amid favorable end market conditions and tight industry supply

- Expect strong agricultural industry fundamentals to continue; Typical North America ammonium sulfate seasonality expected to drive 3Q21 higher export mix sequentially

- Expect robust demand for chemical intermediates to continue; Acetone industry fundamentals to remain strong with continued balancing of supply and demand in 2H 2021

- Expect Capital Expenditures to be $65 to $70 million in 2021 (compared to prior expectations of $70 to $80 million) reflecting timing of project execution

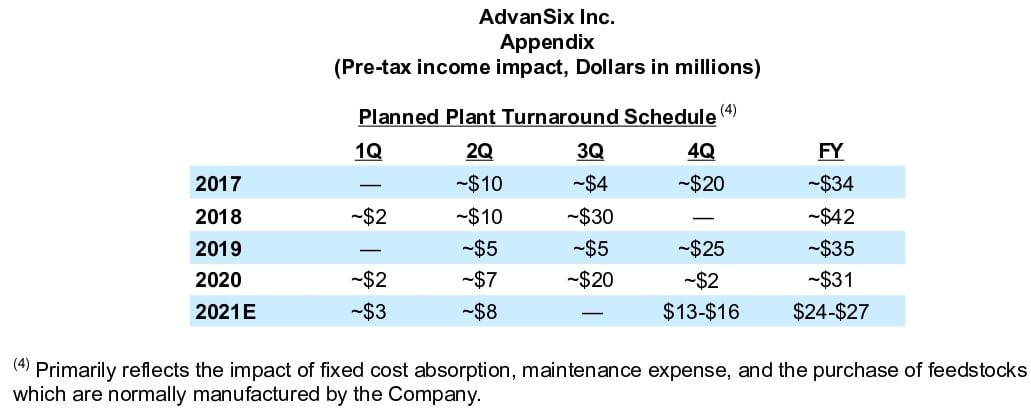

- Driving efficiencies in planned plant turnaround programs – expect pre-tax income impact of $24 to $27 million in 2021 (compared to prior expectations of $25 to $30 million)

“We continue to execute against a focused strategy and the outlook for our business remains favorable. The continuation of strong underlying demand trends across our core markets, benefits from our high- return capital projects and differentiated product portfolio, and our operational agility are all supporting expected record earnings and cash flow in 2021. We are approaching the five-year anniversary of our spin-off and our organization’s collective efforts throughout this time have positioned the company for long-term success. We are excited to share more about our ability to deliver strong and sustainable shareholder returns at our upcoming Investor Day scheduled for September 28,” added Kane.

Conference Call Information

AdvanSix will discuss its results during its investor conference call today starting at 9:00 a.m. ET. To participate on the conference call, dial (833) 756-0862 (domestic) or (412) 317-5752 (international) approximately 10 minutes before the 9:00 a.m. ET start, and tell the operator that you are dialing in for AdvanSix’s second quarter 2021 earnings call. The live webcast of the investor call as well as related presentation materials can be accessed at http://investors.advansix.com. Investors can hear a replay of the conference call from 12 noon ET on July 30 until 12 noon ET on August 6 by dialing (877) 344-7529 (domestic) or (412) 317-0088 (international). The access code is 10153579.

About AdvanSix

AdvanSix plays a critical role in global supply chains, innovating and delivering essential products for our customers in a wide variety of end markets and applications that touch people’s lives, such as building and construction, fertilizers, plastics, solvents, packaging, paints, coatings, adhesives and electronics. Our reliable and sustainable supply of quality products emerges from the vertically integrated value chain of our three U.S.-based manufacturing facilities. AdvanSix strives to deliver best-in-class customer experiences and differentiated products in the industries of nylon solutions, chemical intermediates, and plant nutrients, guided by our core values of Safety, Integrity, Accountability and Respect. More information on AdvanSix can be found at http:// www.advansix.com.

Forward Looking Statements

This release contains certain statements that may be deemed “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, that address activities, events or developments that our management intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements may be identified by words such as “expect,” “anticipate,” “estimate,” “outlook,” “project,” “strategy,” “intend,” “plan,” “target,” “goal,” “may,” “will,” “should” and “believe” and other variations or similar terminology and expressions. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and difficult to predict, which may cause the actual results or performance of the Company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: general economic and financial conditions in the U.S. and globally, including the impact of the coronavirus (COVID-19) pandemic and any resurgences; the scope, duration and pace of recovery of the pandemic; the timing of the distribution and efficacy of vaccines or treatments for COVID-19 that are currently available or may be available in the future and related vaccination rates; the severity and transmissibility of newly identified strains of COVID-19; governmental, business and individuals’ actions in response to the pandemic, including our business continuity and cash optimization plans that have been, and may in the future be, implemented; the impact of social and economic restrictions and other containment measures taken to combat virus transmission; the effect on our customers’ demand for our products and our suppliers’ ability to manufacture and deliver our raw materials, including implications of reduced refinery utilization in the U.S.; our ability to sell and provide our goods and services, including as a result of travel and other COVID-19-related restrictions; the ability of our customers to pay for our products; and any closures of our and our customers’ offices and facilities; risks associated with increased phishing, compromised business emails and other cybersecurity attacks and disruptions to our technology infrastructure; risks associated with employees working remotely or operating with a reduced workforce; risks associated with our indebtedness including compliance with financial and restrictive covenants, and our ability to access capital on reasonable terms, at a reasonable cost or at all due to economic conditions resulting from COVID-19 or otherwise; the impact of scheduled turnarounds and significant unplanned downtime and interruptions of production or logistics operations as a result of mechanical issues or other unanticipated events such as fires, severe weather conditions, natural disasters and pandemics; price fluctuations, cost increases and supply of raw materials; our operations and growth projects requiring substantial capital; growth rates and cyclicality of the industries we serve including global changes in supply and demand; failure to develop and commercialize new products or technologies; loss of significant customer relationships; adverse trade and tax policies; extensive environmental, health and safety laws that apply to our operations; hazards associated with chemical manufacturing, storage and transportation; litigation associated with chemical manufacturing and our business operations generally; inability to acquire and integrate businesses, assets, products or technologies; protection of our intellectual property and proprietary information; prolonged work stoppages as a result of labor difficulties or otherwise; cybersecurity, data privacy incidents and disruptions to our technology infrastructure; failure to maintain effective internal controls; disruptions in transportation and logistics; potential for uncertainty regarding qualification for tax treatment of our spin-off; fluctuations in our stock price; and changes in laws or regulations applicable to our business. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Such forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by such forward-looking statements. We identify the principal risks and uncertainties that affect our performance in our filings with the Securities and Exchange Commission (SEC), including the risk factors in Part 1, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020, as updated in subsequent reports filed with the SEC.

Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures intended to supplement, not to act as substitutes for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in this press release. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided. Non-GAAP measures in this press release may be calculated in a way that is not comparable to similarly- titled measures reported by other companies.

# # #

Contacts

Media:

Debra Lewis

(973) 526-1767

debra.lewis@advansix.com

Investors:

Adam Kressel

(973) 526-1700

adam.kressel@advansix.com